Car finance deals accelerate once again

- April 14, 2017

- Martin Young

- 0 Comments

The motor finance market appeared to have hit new heights yesterday when the industry’s main lobby group reported another quarter of double-digit growth.

First-quarter motor financing activity rose by 10 per cent year-on-year by value and 3 per cent by volume, according to the Finance & Leasing Association, which said that the growth was in line with its expectations for single-digit growth over the course of the year.

Car financing plans have grown in popularity over the past decade and the FLA said that its members had financed 86.5 per cent of all cars bought in the year to the end of March, compared with 82.7 per cent for the same period last year.

It said that 305,406 cars had been bought using finance deals in the first quarter, with the total value of advances handed to customers reaching £5.51 billion, an increase of 10 per cent on the year. For the 12-month period, the value of advances was £18.6 billion, up 9 per cent year-on-year.

Some industry watchers have warned that the market is overheating. Alex Buttle, at Motorway.co.uk, an online car selling website, said that the used car market could lead to problems, as many financing plans relied on a relatively buoyant market to ensure that lenders can sell on vehicles as deals come to an end.

“We could be looking at a perfect storm, as the majority of car finance deals are PCPs, which are calculated according to how the car depreciates, at a time when car values could start falling at a rate of knots,” he said.

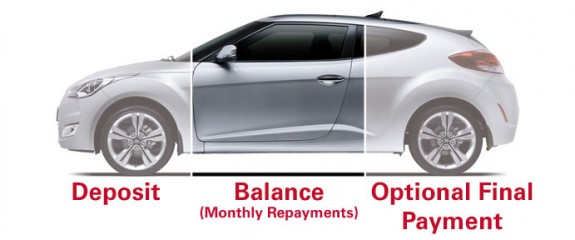

About three quarters of customers who use finance to buy a car use a PCP, or personal contract plan. Under these, the buyer effectively leases the car and funds the value of its depreciation over the life of the contract, at the end of which the lender agrees to buy the car for a guaranteed price. However, if used car prices were to drop faster than expected, lenders in turn could face heavy losses.